The Overvaluation of Network Effects

Mistaking Adoption For Value

Network effects have long been touted as a key value driver in the crypto space.

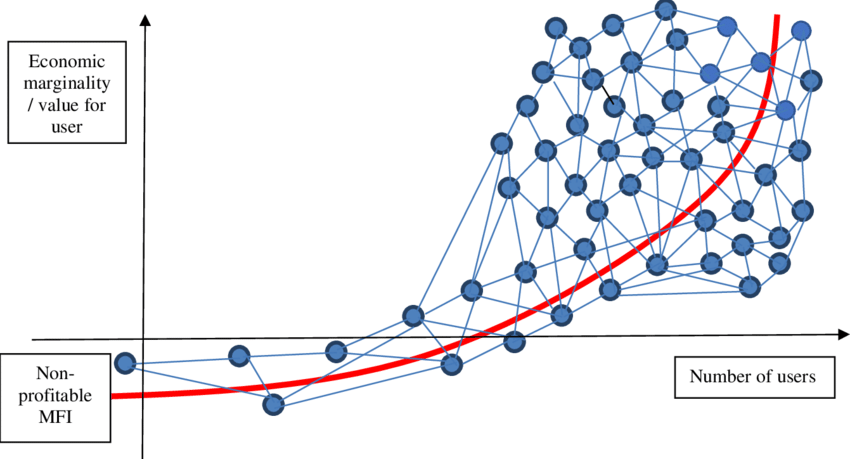

The idea is simple: as more users join a network, the value of that network increases exponentially, creating a virtuous cycle of growth and value creation. This concept, a staple from traditional software, has become a cornerstone of many project valuations. The assumption is that as more users join a network, the utility and value of the network grow, leading to a positive feedback loop of adoption and value creation.

Network Effects (source: Medium)

The overall logic behind this is simple. As we increase the number of users or nodes, we exponentially increase the number of connections in the ecosystem. In a fully connected network with n participants, the number of possible connections is:

If we assume that connections are valuable (presumably so because they create peer-to-peer interactions), this results in a powerful growth effect. In this case, the network's value increases significantly with each additional participant. Every new participant adds value not just for themselves but for every other participant as well, making the entire network more valuable.

We can apply this concept across a wide range of blockchain networks and crypto ecosystems. Take Bitcoin, whose value is often attributed to its large and growing user base, which increases its utility both as a medium of exchange and a store of value. Similarly, DeFi protocols like Uniswap benefit from network effects as more users provide liquidity, making the platform more attractive to traders, which in turn attracts more liquidity providers—an equation for exponential growth.

However, network effects are not everything.

In the rush to capture market share and grow user bases, many projects may overestimate network power, mistaking rapid adoption for sustainable value creation. While network effects are important, they are not a silver bullet, and overreliance on them could lead to long-term disillusionment and value destruction in the space.

The Overvaluation Problem

While network effects are real, their impact on value can often be overstated in the crypto space. There are several primary reasons why this overvaluation occurs:

Speculative adoption vs. genuine utility

In many cases, rapid adoption of a protocol or technology is driven by speculation rather than genuine utility. While rapid growth is lauded on paper, this too often leads to a collapse in network value. For example, in the realm of DeFi, many users may flock to a particular protocol because of high-yield incentives, not because the protocol offers superior functionality or value. When these incentives dry up, users may leave just as quickly as they arrive, collapsing the value of the network.

The summer of 2020 (“DeFi Summer”) marked a period of explosive growth in the realm of DeFi, and yield farming was at the heart of this boom. The incentives associated with yield farming attracted a wave of participants eager to maximize their returns in a low-interest-rate environment, fueling a frenzy of activity across DeFi ecosystems. Total value locked (TVL) in DeFi skyrocketed from less than $1 billion in early 2020 to over $10 billion by September of that year.

Then the wolf reared its head—and speculative mania showed its consequences. Once the initial excitement wore off, many governance tokens experienced sharp price declines. The decline in token prices led to a negative feedback loop: as token values dropped, the yields (denominated in those tokens) became less attractive, causing liquidity providers to withdraw their assets and further depressing token prices. As yields declined, liquidity providers began to exit en-masse, leading to a sharp reduction in TVL across many protocols. The capital that had flooded into DeFi during the summer started to dry up.

The booming network effect at initiation did not, in fact, signal long-term value.

Network saturation

One very important property of network effects is that they have diminishing returns. In other words, as a network grows, the incremental value of each new user decreases. In highly saturated networks, new users may contribute little to overall value, and the costs of maintaining and securing the network may outweigh the benefits of further growth.

Consider Ethereum; network effects have made Ethereum the dominant platform for dApps, DeFi, and NFTs—but such effects are also a double-edged sword. While they’ve contributed to a large and active user base, they’ve also placed enormous strain on the network and revealed early on the limitations of its infrastructure.

There is a clear trade-off between security and scalability. Ethereum’s architecture prioritizes security and decentralization but at the expense of scalability. This trade-off became painfully apparent during both the 2017 ICO boom and the 2021 NFT craze. The network’s inability to scale effectively during periods of high demand led to user frustration and increased competition from other blockchains.

While network effects are a key driver of value, they are not a panacea. Technical challenges (scalability) from over-saturation can undermine the benefits of network effects and ultimately create opportunities for competitors to gain market share.

Misalignment between network size and token value

Perhaps counterintuitively, the value of a network's native token does not always scale linearly with the size of the network. While the math dictates that the number of connections between users follows an exponential growth trajectory, this does not necessarily translate to a proportional scale in value. In some cases, the market cap of a token may become inflated relative to the actual utility provided by the network. This misalignment can lead to speculative bubbles that are prone to bursting.

Metcalfe’s Law suggests that the value of a network is proportional to the square of the number of its users (n^2). This law is often cited to justify the rapid appreciation of a network’s token value as its user base grows.

Metcalfe’s Law (source: ResearchGate)

In theory, the economic marginality (interpreted as the value per user) grows exponentially as the number of users (and therefore connections) increases. This value per user appears to approach an infinite tendency as the number of nodes increases in the network.

However, in practice, the application of Metcalfe’s Law to blockchain networks is oversimplified, and this theoretical model disregards external factors. It ignores critical aspects of network dynamics, particularly in the context of decentralized systems.

A key aspect justifying this is marginal utility decline. In the early stages of a network's growth, each additional user or dApp can significantly enhance the network's utility, leading to a corresponding increase in value. However, as the network scales, the marginal utility of each additional user may decrease. For example, while the first few DeFi applications might attract significant user interest and liquidity, the 100th dApp might not add much incremental value unless it introduces something radically new or solves an existing problem better than its predecessors. This reality instead suggests a somewhat asymptotic limit to increasing value with additional users.

Furthermore, a notable attribute of many current protocols is the roadblock of congestion. When a decentralized network becomes congested, or the added connections are not as meaningful, we do not achieve the apparent infinite value creation through more users as Metcalfe’s model suggests.

False network effects

In some cases, network effects can be overstated and misleading. For example, a network may have a large number of users, but if those users are not actively engaged or if the network's applications do not generate significant economic activity, the impact on token value will be limited.

Additionally, as mentioned before, if a network grows rapidly due to incentives or speculation rather than organic adoption, the resulting network effects may be fragile and short-lived. Once incentives decrease or speculation wanes, the network may experience a rapid exodus of users, leading to a sharp decline in value. This is the shortfall of network effects — they are not an inherently accurate tell-tale sign of a protocol’s long-term value.

Competitive dynamics

Network effects can also be eroded by competition. In the fast-evolving crypto space, new projects with better technology or more attractive incentives can quickly siphon off users from established networks (e.g. significant developer migration from Ethereum to Solana). This competitive pressure can undermine the value derived from network effects and lead to a redistribution of users rather than a net increase in value.

More Important Than Network Effects

What matters most of all for the long-term success of blockchain networks? Three words: sustainable value creation.

True value creation in a blockchain network requires more than just user growth and the idolized network effect; it requires a sustainable economic model where the network generates real utility for users and healthy demand for its native token. This includes use cases that go beyond speculation for some future value.

The relationship between network growth and value is complex and non-linear. While rapid growth in users and applications can drive initial increases in network/token value, this growth does not guarantee sustained value appreciation. Factors such as diminishing returns on network utility, short-term speculation, and the disconnect between market sentiment and fundamentals all contribute to this non-linear relationship. The industry is littered with examples of projects that saw rapid adoption but failed to sustain their value creation over time. For blockchain networks to achieve long-term success, they must focus on sustainable growth, robust tokenomics, and creating genuine utility for consumers that drives ongoing demand for their native tokens.